NeoDynamics

Analysis of NeoDynamics at georgssons.com

Published: 2023-02-16

Updated: 2023-02-23

Analyst: Daniel Georgsson

Own holding: Yes

Biopsy taking with high accuracy provides better cancer diagnosis

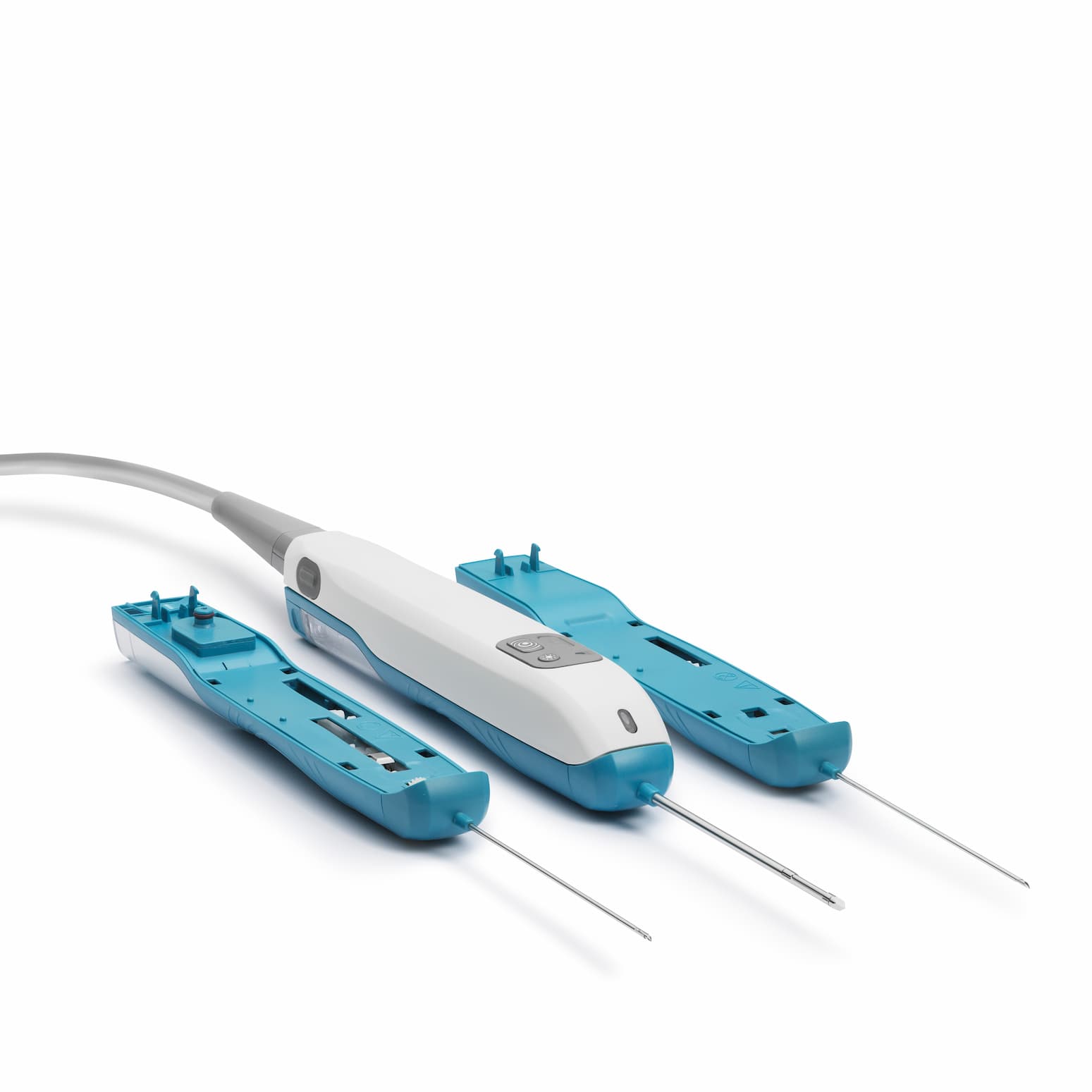

NeoDynamics is a Swedish company that developed, patented and sells NeoNavia - an innovative new system for ultrasound-guided biopsy taking with great precision.

The proprietary FlexiPulse™ needle type provides higher precision and greater tissue yield than previous needle types. Traditional needle types can also be used with NeoNavia's pulse technology, making the system complete for customers' biopsy needs.

Medical advances

Diagnosing breast cancer is the first area of focus for NeoDynamics. Tissue samples are taken with breast biopsy and the patented needles in NeoNavia provide greater precision compared to traditional biopsy techniques while minimizing damage to nearby tissue with the pulse technique used when inserting the needle.

Tissue samples are of high quality and the precise pulse-controlled needle insertion enables sampling of very small tumors and in places not accessible with traditional needle types. Based on research at Karolinska Institutet, the system has been developed by NeoDynamics AB.

Tomorrow's breast cancer biopsy

NeoDynamics' vision is to establish a new standard.

- “NeoDynamics vision is that our pulse technology will become the new standard for all ultrasound-guided breast cancer biopsies, and that precision and reliability will be improved, thereby helping to save lives and improve the quality of life of all women with breast cancer. ”

- Anna Eriksrud, CEO

Approval in the United States

In September 2022, NeoDynamics has received approval from the USA Food and Drug Administration (FDA) for the sale of the biopsy system Neonavia on the large USA market.

CE marking and products approved in Europe and the USA open up a market in breast biopsy that by 2025 is estimated to be worth USD 1,094 million globally.

The stock

The share is traded on the Nasdaq First North Growth Market under the ticker NEOD and ISIN code SE0011563410.

Redeye AB is Certified Advisor.

Analyst Commentary

Approval is in place for the important US market. Agreement on distribution and agreement on assistance with medical information management have been signed.

The first expected interaction with customers in USA is during the annual conference of the American Society of Breast Cancer Surgeons in April 2023.

In contrast to Europe, where costs are very important, NeoNavia is launched in the USA as a product in the premium segment with greater opportunities to charge well for the benefits the system provides.

With a complete biopsy system and a proprietary new needle type that takes cancer diagnostics to the next level of accuracy, the potential is very large both medically and commercially.

Approval in the USA paves the way for China

Approval in the USA likely increases the chances of getting the biopsy system approved in China as well.

New level of precision in biopsy

The proprietary needle type in combination with the patented pulse technology for needle insertion takes cancer diagnostics to the next level of accuracy, the potential is very large both medically and commercially.

About the analysis

The analysis is based on public information. First analysis in October 2018 and publication in February 2023.

Daniel Georgsson himself owns shares in the company and has no further insight than other shareholders.

Advantages compared to competitors

With NeoNavia, NeoDynamics offers improved traditional needle types while adding a new and more precise needle type. NeoNavia is a complete system that can replace other ultrasound-guided biopsy systems at a reception.

Protective patent

Approved patents are found in major European countries as well as in China and the USA. The company's various patents expire in 2034 and additional patent applications have been filed.

Swedish company with global potential

NeoDynamics has begun work on commercializing NeoNavia. There is an established organization for sales in Europe and the USA.

NeoDynamics works in close collaboration with clinics where the products are used and further developed. After the approval in the US, the company has shown that they can take their product into important markets globally.

Owners and Management

In both management and the board there is a lot of collective experience in medical technology and the pharmaceutical industry.

Management

Anna Eriksrud, CEO

Anna Eriksrud has over 25 years of experience from pharmaceutical and medical technology companies worldwide.

Magnus Olsen, CDO & COO

Magnus Olsen has over 15 years of experience in medical technology R&D. Project management, process development, management of project portfolio at St. Jude Medical. Holds a master degree in engineering.

Kai-Uwe Schässburger

Kai-Uwe Schässburger, Ph.D is Director Clinical Development & Medical Affairs with over 10 years of experience from R&D and clinical validation in interventional radiology from academia and industry. Doctor of Medical Science.

Aaron Wong, CFO

Aaron Wong has many years of experience as CFO and several other financial assignments at, for example, Johnson & Johnson. Experience in life science, financial market and transactions. Aaron Wong did his BA in Accounting & Finance at the British De Montford University in Leicester and is a fellow of the Association of Certified Chartered Accountants (FCCA).

Ian Galloway

Ian Galloway is Country Manager UK & Ireland with over 20 years of experience in the pharmaceutical and medical industry. Leadership, business development, sales and marketing are areas where Ian brings and is described as an entrepreneur, founder of a CQC registered healthcare service and UK based clinical and commercial consultancy.

Renate Reiss

Renate Reiss is country manager for the DACH countries Germany, Austria and Switzerland with over 25 years of life science and consulting experience. International business management, marketing and sales in several regions (USA, APAC, EUCAN, EMEA, South America).

Matthew E. Colpoys, Jr.

Matthew E. Colpoys, Jr. is head of the USA subsidiary and reports to CEO Anna Eriksrud. Mr. Colpoys has over 35 years experience in the biopharmaceutical/medtech industry. Most recently he founded and led Tactiva Therapeutics, Inc., an Immuno-Oncology start up, through their $35M Series A fund raise. He was a key member of the early commercial and management teams at Genentech (Sold to Roche), Pharmacia (Sold to Pfizer), Neurex (Sold to Elan) and Insmed. At these companies his integral participation resulted in a number of successful commercial product launches, two of which resulted in products currently selling in excess of $300M (US). As President of Galileo Consulting, a global biopharmaceutical advisory and consulting practice, he has assisted a wide range of companies in their business development, strategic planning, fundraising and M&A activities.

Anna Forsberg

Anna Forsberg is Medical Affairs Manager & Country Manager USA with over 25 years of experience from the pharmaceutical and medical industry in the USA and Europe, including medical affairs, medical communication, clinical research, medical marketing and project management.

Brendan Carney

Brendan Carney has more than 20 years of experience that includes companies such as Genentech and Pharmacia. Management of teams and product launches in oncology, infectious diseases, endocrinology and medical devices

Board

NeoDynamics' board has extensive experience from the medical technology, pharmaceutical and financial industries.

Ingrid Salén

Chairman of the board Ingrid Salén is a civil engineer with experience from, among others, Scania CV AB. The large own holding of shares via Rentability Sweden AB makes the chairman of the board one of the major shareholders.

Carina Bolin

Carina Bolin is a trained lawyer with close to 35 years of experience in legal work, of which 30 years in internationally active organizations. Former chief legal officer for companies in life science/medical technology, lawyer at ABB AB and the intellectual property law firm Brann AB, among others.

Claes Pettersson

Claes Pettersson is a civil engineer with a higher education in economics. Has been CEO and/or board member in around 25 wholly or partially owned companies in various sectors. Co-founder and management positions Alfaskop AB (publ). CFO in Kreatel Communications AB, Sick IVP AB and AMRA Medical AB. CFO and CEO assignments in Impact Coatings AB (publ). Current assignments include board member and vice chairman of Åtvidabergs Sparbank.

Matthew E. Colpoys, Jr.

Matthew E. Colpoys, Jr. graduate of Canisius College and over 35 years of experience in the pharmaceutical industry with commercial, business development and management positions at Genentech, Pharmacia, Neurex and Insmed and others. Experience as President at Galileo Consulting, a global advisory and consulting company in biopharma.

US approval paves way for growth.

Anna Eriksrud wrote in the report for Q3 2022 about what approval and launch in the US could mean.

Some quotes from the CEO in the report for Q3 2022:

- “The hard work we put into preparing and submitting a strong file to the US Food and Drug Administration (FDA) for a US commercialization - paid off in the third quarter, with approval by the FDA of our innovative pulse biopsy system NeoNavia.”

- “The approval is a major milestone for NeoDynamics as it means we can now push forward quickly to begin introducing the system to a massive market. The US breast biopsy market is expected to reach $830 million by 2025.”

Business model

NeoNavia provides revenue initially and over time

With NeoNavia, clinicians purchase a complete biopsy system where the base unit is the larger initial investment.

Needles are then consumables that provide continued income over time.

NeoNavia is a complete biopsy system

NeoNavia can be sold as a complete system that can handle both traditional needle types and the new patented needle type with improved precision. From the outset, NeoNavia can replace all other ultrasound-guided biopsy systems in one practice.

An alternative way to introduce the system to customers is to sell NeoNavia as a complementary expert system with high precision, in order to later broaden the offer to replace existing biopsy systems with traditional needle types.

Base unit provides initial income

Customers purchase a system where the base unit and needle application probe constitute the initial transaction along with a number of needles of one or more needle types.

Needles provide ongoing income

Needles are consumables and provide ongoing income. Entering a customer with one or more needle types makes the deal long-term and scalable with possible additional sales over time of more needle types.

Clinical studies create confidence

NeoDynamics has conducted and is conducting successful clinical studies that have shown that NeoNavia is safe and effective with good performance and that both higher tissue yield and higher needle speed are achieved compared to competing products.

Economics

You can read more about income, costs and cash flow here.

Income and expenses

Several biopsy systems have been sold in Europe but sales have been slowed by the pandemic which prevented visits to clinics. Revenues have been relatively small, while costs for recruiting and maintaining sales organizations in important markets remain.

In Europe, the market is under price pressure, so there is need to increase volume. The USA market offers greater opportunities for margin improvements and NeoDynamics aims at the premium segment when establishing itself in the USA market.

During 2022, production and sales of some needle types were paused to implement improvements since the needle types were evaluated in European clinics. After the optimization, revenue from the sale of needles is expected to start again.

Cash flow

NeoDynamics' funds are expected to last a bit into 2023. Increased income or some form of capital injection is likely to be needed during the year.

In February NeoDynamics' largest owner secured the launch of NeoNavia in the US by providing the company a loan of SEK 14 million.

Potential

In addition to breast biopsy, NeoNavia can be used for other indications, but the market for breast biopsy alone is large. Even small shares can generate large revenues.

Many applications

Breast cancer is a clear focus initially, but there are many other forms of cancer that can benefit from more efficient biopsy techniques in diagnosis.

Complementary products are developed

NeoDynamics is developing its own biopsy marker. Biopsy markers can improve the efficiency of breast cancer diagnosis and as imaging technology improves, the visibility of biopsy markers during imaging increases.

In the US, biopsy markers are common and in Europe their use has started to spread among doctors. Increased sales of biopsy markers increase revenue for those who sell biopsy needles.

Big market

Globally, around 2.1 million women are diagnosed with breast cancer per year and the number increases by 4-5% annually. Every year more than 600,000 women die as a result of breast cancer so there is a strong drive towards improved diagnosis.

According to the company's calculations, at least six million breast biopsies and axillary biopsies are performed annually to diagnose suspected cancer. The breast biopsy instruments market was worth around USD 725 million in 2020. With an expected annual growth rate of 8.6%, the market segment is estimated to be worth around USD 1,095 million by 2025.

Competitors

Information about competitors to NeoDynamics.

Information about competitors

NeoDynamics describes CR Bard, Devicore Products and Hologic as main competitors.

CR Bard

In 2017, CR Bard was bought by BD, which is one of the world's largest companies active in medical technology. It is difficult to find comparable figures. The entire company had, according to the annual report for 2021, revenues of over USD 20 billion. In the 'peripheral intervention' segment, which includes biopsies, revenue was USD 1.7 billion.

Devicore Products

The Mammotome biopsy system from Devicor Medical Products, Inc is a competitor. Devicor Medical has been owned since 2014 by the large medtech company Danaher. It is difficult to find comparable figures. The entire company had, according to the annual report for 2021, revenues of over USD 29 billion. In the 'diagnostics' segment, which includes biopsies, revenue was USD 9.8 billion.

Hologic

In addition to mammography equipment, Hologic, Inc. also has a biopsy system. It is difficult to find comparable figures. The entire company had, according to the annual report for 2021, revenues of USD 5.6 billion.

More information

The NeoNavia biopsy system

The movie about NeoNavia

https://www.neodynamics.com/en-gb/

Read about the biopsy system that is the basis of the company's offer.

https://www.neodynamics.com/en-gb/biopsy-system/

Publications

Read the scientific publications that are published on the website.

https://www.neodynamics.com/en-gb/publications

NeoDynamics on youtube

Watch videos about NeoNavia on Neodynamic's YouTube channel.

About market potential

More about market potential at marketsandmarkets.

https://www.marketsandmarkets.com/

Market-Reports/biopsy-devices-breast-biopsy-market-189011805.html