Responsible trading

Education at georgssons.com

Published: 2021-11-12

Updated: 2023-02-24

Introduction

Trading shares with low turnover can be done with regard to existing shareholders and current legislation.

Shares with low turnover

When trading in shares where turnover is low, each trading item is more important for the share price than it is in shares with high turnover.

Price is what you pay. Value is what you get

A quote from Warren Buffet is that “Price is what you pay. Value is what you get” and it fits in with trading in stocks that have low turnover. When not many others show interest in a share, it is possible to get value at a good price.

When news about the company arrives that makes more people want to trade in the share, the price can change quickly. If you have already shopped when it was calmer trade, just sit quietly while the buyers flock to own a piece of the same company that you are already a part ownner of.

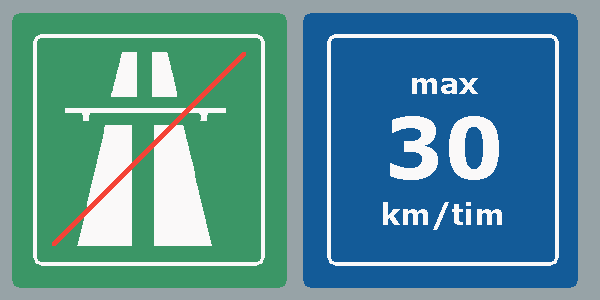

Current legislation

Buying shares in a small company because they have an interesting business idea is allowed. Telling others that the company exists is also allowed as long as what is being told is true. Giving incorrect information to drive up the price and then sell is a crime (”pump and dump”).

Buying individual shares at a high or low price to influence the price is not permitted.

Buying or selling between your own securities depots to influence the price is not permitted.

The risk of being investigated for market abuse when trading in shares is greater in shares where turnover is low than in shares with high turnover. You can read it on the Swedish Financial Supervisory Authority's website:

”The Market Abuse Regulation (Mar) defines the following as market abuse:

- Insider trading

- Illegal disclosure of inside information

- Market manipulation.”

More information on market abuse can be found at Swedish Financial Supervisory Authority's website fi.se

Existing shareholders

When trading in shares where turnover is low, each trading item is more important for the share price than it is in shares with high turnover. Buying or selling many shares at the same time can lead to the share price rising or falling if there is low turnover.

Trading too fast in shares that usually have low turnover can lead to the share price being affected a lot. Rapid rise often leads to rapid decline. With time to trade slowly, it is possible to get into position without the price being driven up by one's own purchase. When the company communicates progress that leads to increased interest in the stock and trading volume, the patient purchase can be richly rewarded.

Liquidity guarantor

Some small companies hire a liquidity guarantor who ensures that there are items on both the buying and selling side. With patience, it is possible to buy more shares when the liquidity guarantor has filled in the order depth.

Large units of shares

If you want to buy larger units of shares, it may be a good idea to contact the company or certified advisor. There may be investors who want to step down and then a unit of shares can be brokered without driving up the price in the short term.

Summary

Trading with regard to existing shareholders and current legislation can be summarized as follows:

- Trade smaller items at a stock price that is fairly close to the current price.

- Avoid really small quantities of stock.

- Avoid being on both the buy and sell page in the order book at the same time, ie do not trade with yourself.

- Stick to the facts if you tell or write about the company.